The local market has been proven to be a tough nut to crack and there are some irreplaceable experiences while one shops in a physical store.

-- Tagtoo

With boutique e-commerce overcoming logistical and customer behaviour barriers and building credibility years ago, people are becoming accustomed to place orders digitally and gaining desire for more convenience with a single click on the mouse. More categories ranging from electronic devices to groceries are available in the market; even fresh food experiences growing popularity among businesses with supporting infrastructures such as insulated storing box.

Despite rapid growth in grocery e-commerce sector, it is undoubtedly one of the most capital-intensive spaces in the tech game. But with the potential to give rise to another peak in e-commerce growth, startups and companies fearlessly make a huge bet on this battlefield, eagerly trying to become the one of the remaining winners in this fierce, armed competition.

Clearly, in order to defeat rivals and maintain leading position at the same time, it’s extremely crucial to understand what factors could potentially help company thrive and what decision could lead to its potential failure. As a result, this week, we are going to look into the latest trend and conclude critical points for e-tailers.

1. Millennials and Generation Z are the driver of grocery-business growth

Source : Nielsen Report, other two types are not shown here

People born in the digital era enjoy the unprecedented convenience of tech than any other generations. They embrace innovation and are willing to give it a try even when a new function was just launched. This phenomenon is exactly reflected in the survey carries out by Nielsen in 2015.

The two age segments, 15 to 20 and 21 to 34, are among the second-highest and the highest rates in four different types of e-commerce options (Home Delivery, Automatic Subscription, Virtual Supermarket and Click-and-Pick-Up).

Also, since these two segments are going to shape the future economy for decades and have huge influence on the waiting list of winners, merchants should definitely focus on their interests and optimise customer experience to effectively catch their eyes.

2. Home delivery is the most used option

Source : Nielsen Report

In Asia Pacific, where the Internet penetration is the highest, it is no surprise that Home Delivery becomes the most popular e-commerce subsector due to its convenience for those who spend most time at work. This can be credited to the fact that rapid urbanisation in Asia has brought forth economic development and, at the same time, creates demand for Home Delivery.

On the contrary, the use of Virtual Supermarket is at a much lower rate (only 18 per cent) compared to Home Delivery. The lack of the virtual supermarket in Asia, especially Southeast Asia, and customers’ preference toward physical supermarket could be the explanation. As a result, no matter what type of product they sell, e-commerce grocers should not ignore the importance of Home Delivery and how it can increase revenue by fulfilling customers’ needs — speed and quality.

3. Brick-and-mortar store is still dominant in markets

Source : Mathew Sanders

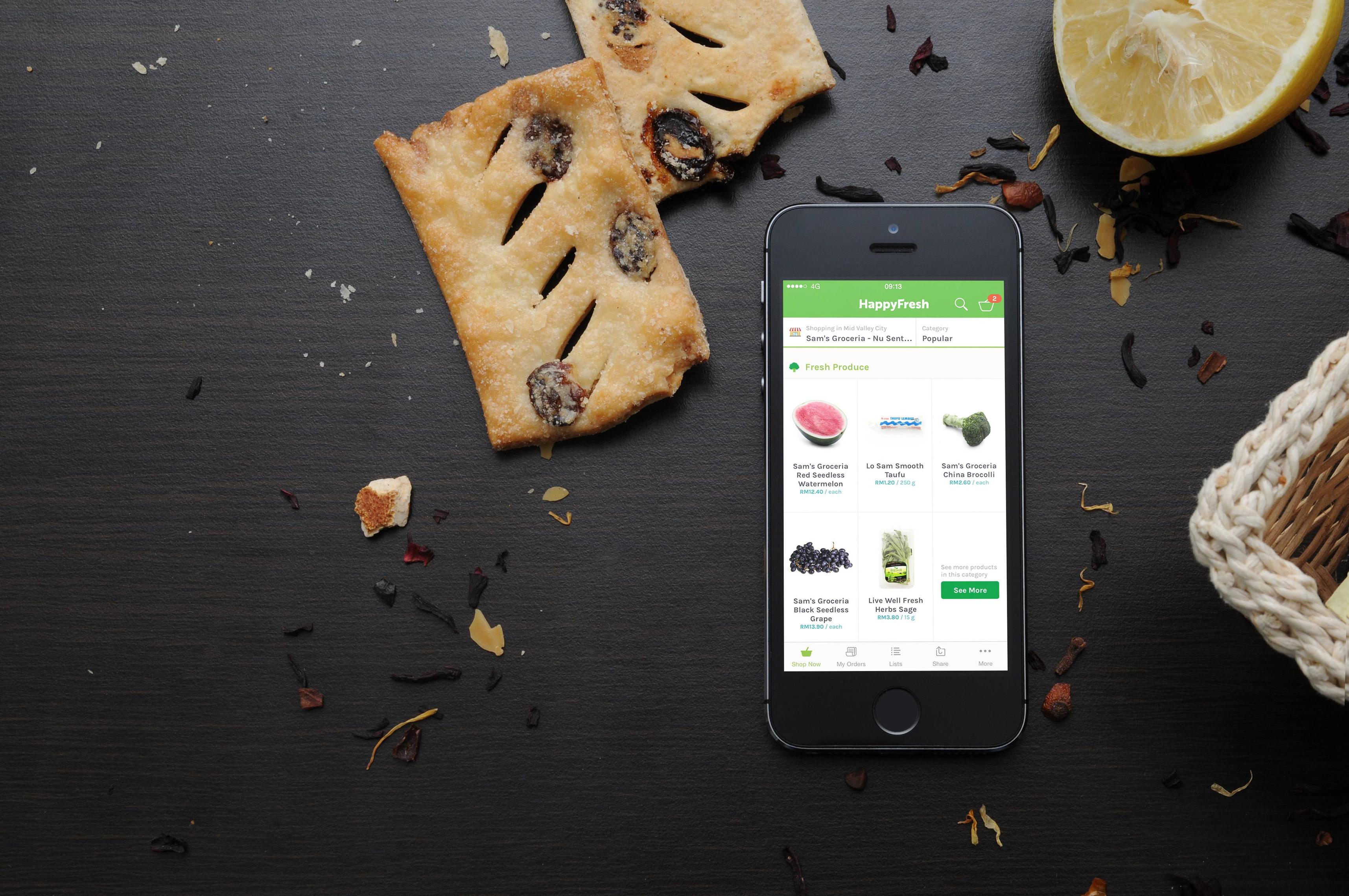

The local market has been proven to be a tough nut to crack and there are, without doubt, some irreplaceable experiences while one shops in a physical store. Take fresh food for example. The smell and real look of the food you choose is something that cannot be expressed on the website, even with lively and beautiful photographs.

Furthermore, even though online shopping greatly affected convenience, the engaging experience with tangible object in a supermarket is a much more enjoyable moment for some individuals and families. The main idea is not to take over the position a physical retail store, but to create a newly cooperative way to bring customer in.

It offers merchants opportunities to make use of the existing channels to come up with a brand-new revenue model without having to make much effort in educating customer. It’s not really a bad thing.

It is reported that grocery e-commerce is about to grow tremendously around the world for certain. The growth rate will remain in two digit. However, since there exist huge differences in lifestyle among regions, merchants should know the market well before taking actions.

Especially in Southeast Asia, where demographics, operating costs, competitive landscape and consumer preferences are much more complicated than any other markets. The points I concluded above from numerous reports is particularly applicable to Southeast Asia, and could potentially send you warning signs for the move you are going to take.

-

Author: Edison Chen, Business Development Manager at Tagtoo